On Thursday, the Biden administration announced a notable initiative that promises to alleviate over $600 million in student loan debt. This significant move aims to provide relief to approximately 4,550 borrowers under the Income-Based Repayment (IBR) plan, along with 4,100 former students of DeVry University. The latter group’s debts were annulled as a result of previously identified substantial misrepresentations made by the for-profit institution regarding its job placement rates, findings of which were disclosed by the U.S. Department of Education in February 2022.

This decision marks a pivotal moment for many borrowers who have been encumbered by student debt. The non-repayable nature of such relief provides an essential lifeline, particularly for those who have found themselves in dire financial situations exacerbated by misleading practices from institutions like DeVry.

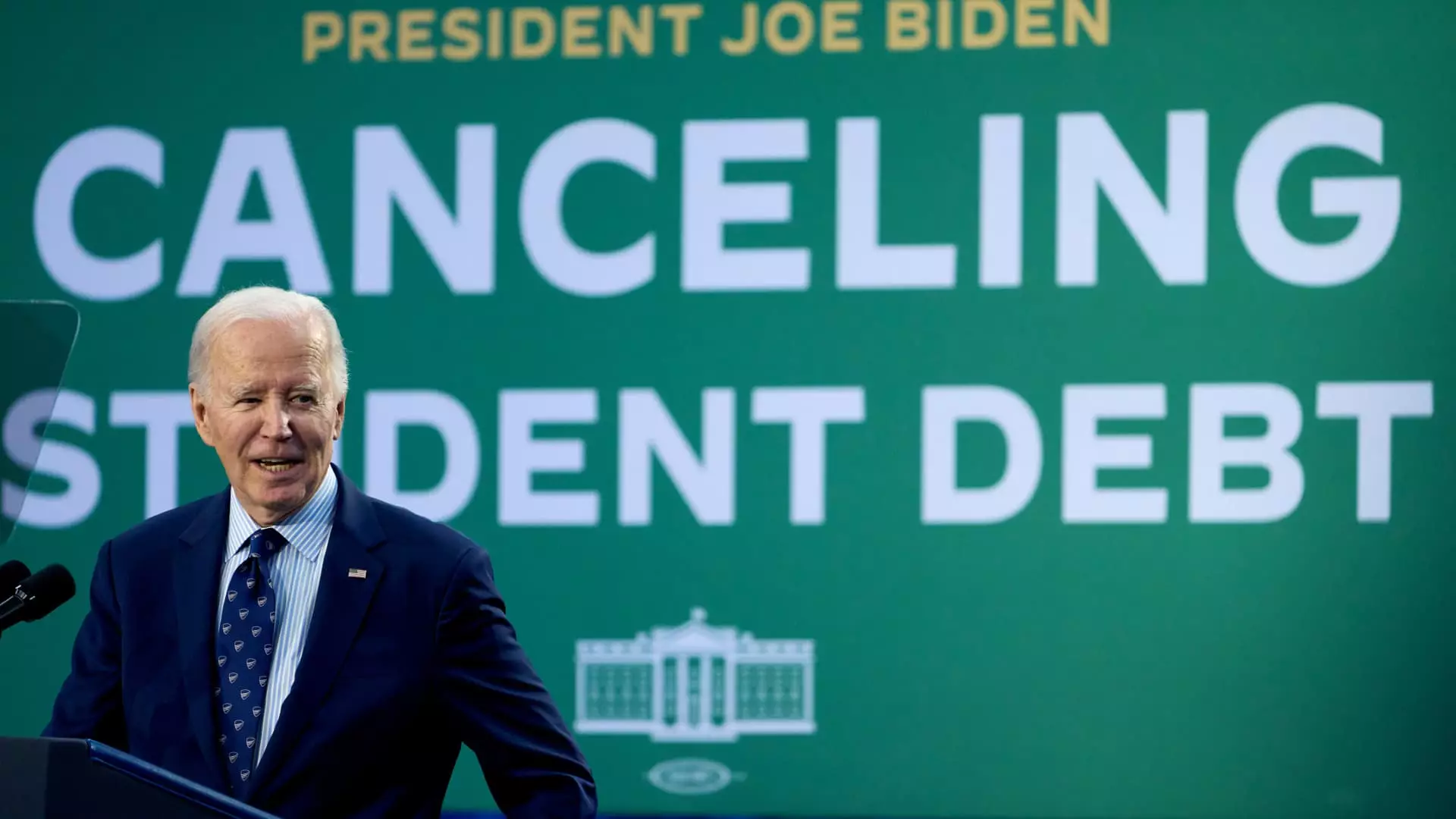

President Biden’s tenure has become synonymous with efforts to tackle the immense burden of student loan debt in the United States. By the end of his presidency, it is estimated that he will have facilitated the cancellation of approximately $188.8 billion in student loans, a staggering figure that encompasses relief for about 5.3 million borrowers. Higher education expert Mark Kantrowitz noted that this moment signifies “the end of an era,” emphasizing that Biden’s administration has forgiven a greater amount of student debt than any previous administration.

However, this achievement is not without its challenges. Earlier in 2023, the Supreme Court blocked Biden’s broader student loan forgiveness plan, which aimed to provide wide-scale relief to millions of borrowers. Despite this setback, the administration has managed to effectuate substantial debt cancellation through revisions to existing Department of Education repayment programs, demonstrating a commitment to the original promise of reforming a fundamentally flawed student loan system.

U.S. Secretary of Education Miguel Cardona articulated the administration’s dedication to revamping a student loan landscape that many deemed broken. “We rolled up our sleeves and, together, we fixed existing programs that had failed to deliver the relief they promised,” he stated. This sentiment reflects a broader acknowledgment of the inadequacies that pervaded the repayment frameworks that many borrowers were previously subjected to.

An important aspect of this initiative is the completion of a payment count adjustment for borrowers engaged in income-driven repayment plans. These plans offer forgiveness after an extended period—typically 20 or 25 years; however, inefficiencies in tracking loan servicers’ handling of borrowers’ timelines have historically hindered outcomes. The Biden administration has sought to rectify these discrepancies, allowing borrowers to monitor their accurate repayment counts via Studentaid.gov.

This final relief round not only signifies an end to the Biden administration’s most notable debt cancellation efforts but also marks a potentially transformative era in which the U.S. acknowledges and begins to address the systemic issues within student loan financing. The ramifications of these decisions will likely echo far beyond Biden’s presidency, affecting many future policies and reforms aimed at reducing the burdens of student debt for countless Americans. President Biden’s ambitious initiatives challenge the standard operating procedures of financial institutions and elevate the dialogue regarding responsible education financing—an important conversation as young Americans continue to grapple with rising tuition costs in pursuit of higher education.